05 Mar 2021

05 Mar 2021

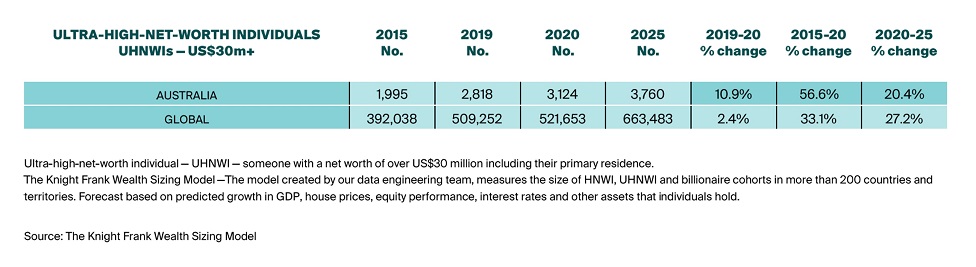

In 2020, Australia's ultra-high-net-worth individual (UHNWI) population – those with net wealth of US$30 million or more - rose by 10.9% to 3,124 people, well ahead of the 2.4% global growth, according to the Knight Frank Wealth Sizing Model in The Wealth Report 2021.

Over the past five years the UHNWI population in Australia grew by 56.6%, significantly more than the 33.1% global growth experienced.

Going forward, the number of ultra-wealthy people in Australia is projected to grow by 20.4% over the next five years to 3,760 people in 2025, trending lower than the 27.2% growth expected globally.

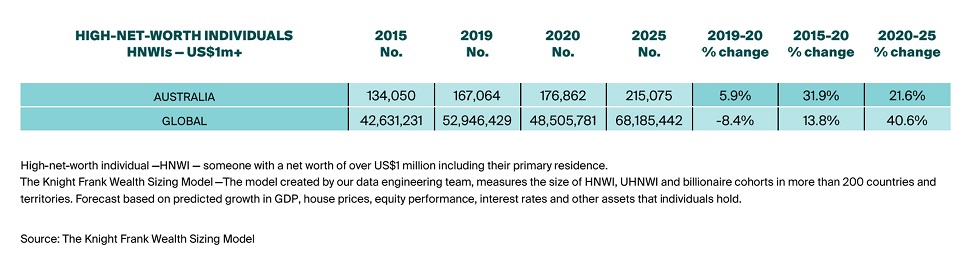

The Knight Frank Wealth Sizing Model also shows Australia's high-net-worth individual (HNWI) population – or the number of millionaires with net wealth of US$1 million or more - grew by 5.9% to 176,862 people in 2020, well ahead of the 8.4% decline in the global HNW population.

Over the past five years, this high-net-wealth population grew by 31.9%, 2.3 times the 13.8% global high-net-wealth growth recorded.

Over the next five years, Australia's HNW population is projected to grow by 21.6% to an estimated 215,075 people, slowing to half of the globally projected 40.6%.

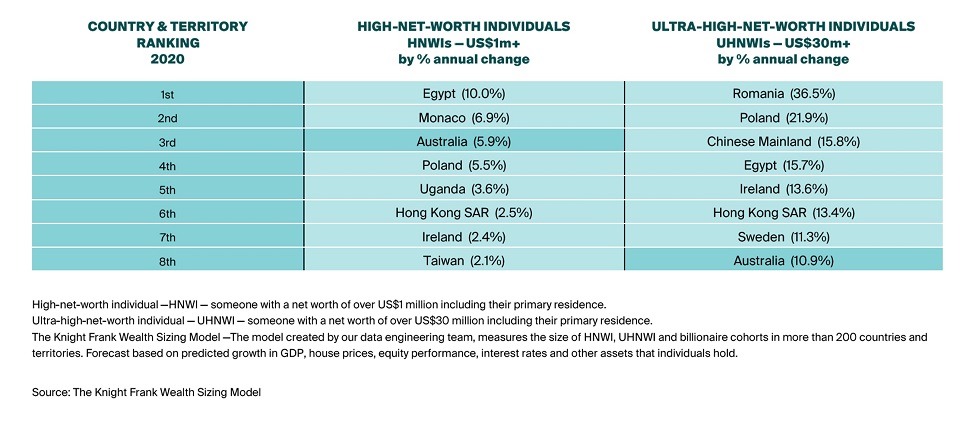

The Knight Frank Wealth Sizing Model found the growth of Australian ultra-high-net-worth individuals ranked eighth globally, while the domestic growth of high-net-worth individuals ranked third from 44 countries and territories ranked in 2020.

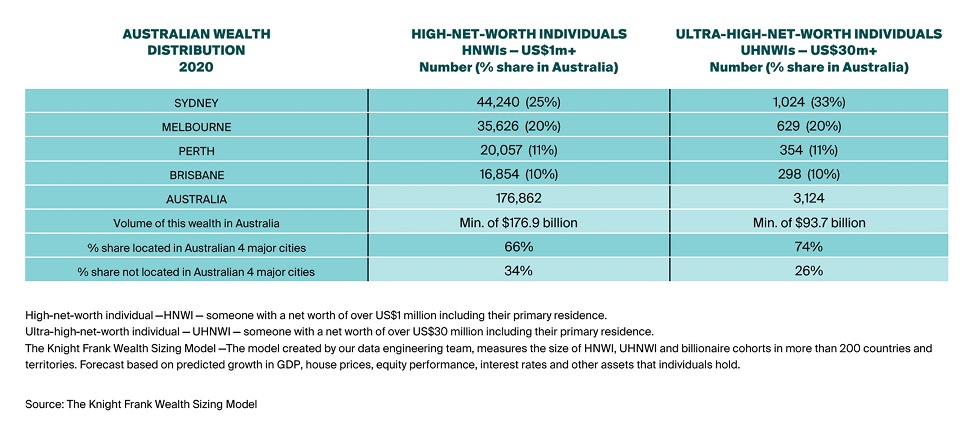

Knight Frank's Head of Residential Research Australia, Michelle Ciesielski said Sydney had the highest share of both ultra-high-net-worth individuals (33%) and high-net-worth individuals (25%) in Australia, followed by Melbourne, Perth then Brisbane.

“Our four major capital cities of Australia comprise 74 per cent of the ultra-high-net-worth population and 66 per cent of the high-net-worth population,” she said.

Ms Ciesielski said Australia had continued to see solid growth in its ultra-wealthy population in 2020 despite the pandemic leading Australia into a recession for the first time in nearly 30 years.

“Although we headed into an uncharted pandemic in the second quarter of 2020, by the end of the year there was strong recovery in both the stock and property markets whilst being in an extraordinarily low interest rate environment, ideal for business investment.

“The Australian government has handled the pandemic rather well by propping up the economy, so wealth has remained relatively unchanged for many, and with closed international borders, much of this wealth has been reinvested locally.

“Compared to well-established countries and territories, the creation of new Australian UHNW and HNW is coming off a relatively low base, so whilst international borders remained closed to new wealthy migrants, projected growth in this population is likely to taper back over the next five years.

“According to the Knight Frank Attitudes Survey, conducted in the last quarter of 2020, 43 per cent of the Australian ultra-high-net-worth population in Australia reported that their source of wealth was their own business, while 30 per cent reported it came from an investment portfolio.”

Knight Frank's Joint National Head of Private Office Sarah Harding said 57 per cent of Australian UHNWIs saw their wealth increase in 2020, ahead of the more subdued 49 per cent recorded across the globe in the Knight Frank Attitudes Survey.

“Looking ahead, 86 per cent of Australian UHNWIs expect their wealth to increase in 2021, which is significantly higher – and more optimistic – than the 71 per cent global average.

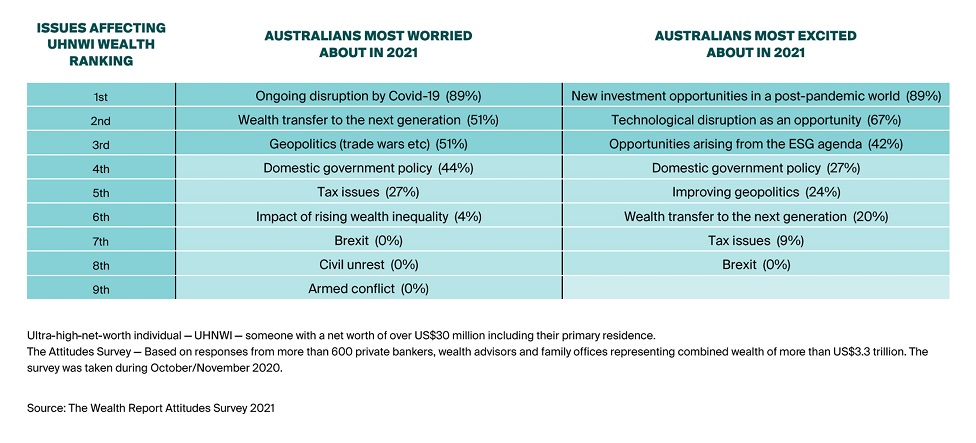

“When we asked our Australian ultra-wealthy clients their plans for 2021, 89 per cent are excited about new investment opportunities in the post-pandemic world, 67 per cent view technological disruption as an opportunity, and 42 per cent are keen to embrace opportunities arising from the ESG (environmental, social and corporate governance) agenda.

“Although counteracting this, the top three cited issues worrying the Australian ultra-wealthy population include the ongoing disruption by COVID-19 (89 per cent), wealth transfer to the next generation (51 per cent) and geopolitics including ongoing trade wars (51 per cent).

“The pandemic has had quite the impact on attitudes of the ultra-wealthy, with more than 80 per cent of the Australian population of UHNWIs expecting to reduce their international travel for business and leisure, and 66 per cent less likely to send their children overseas for university.

“60 per cent of our ultra-wealthy Australian clients say they have reassessed their attitudes to succession planning during 2020 and we expect this to rise further as the pandemic continues into 2021.”

The Wealth Report 2021 also found the number of billionaires in Australia grew by 18.9% to an estimated 44 people in 2020, more than double the 7.1% growth in the global population.

Over the past five years this population grew by 46.7%, significantly higher than the 27.3% global growth recorded, and it is projected to grow by 15.9% over the next five years to an estimated 51 people.

Ms Ciesielski added Australians required US$2.8 million to join the top 1% of the population, by wealth, in 2020.

“This saw Australia ranked seventh globally, by the amount of wealth required, behind countries and territories such as Monaco, Switzerland, the United States, Singapore, New Zealand and Hong Kong SAR.”